Sector Overview

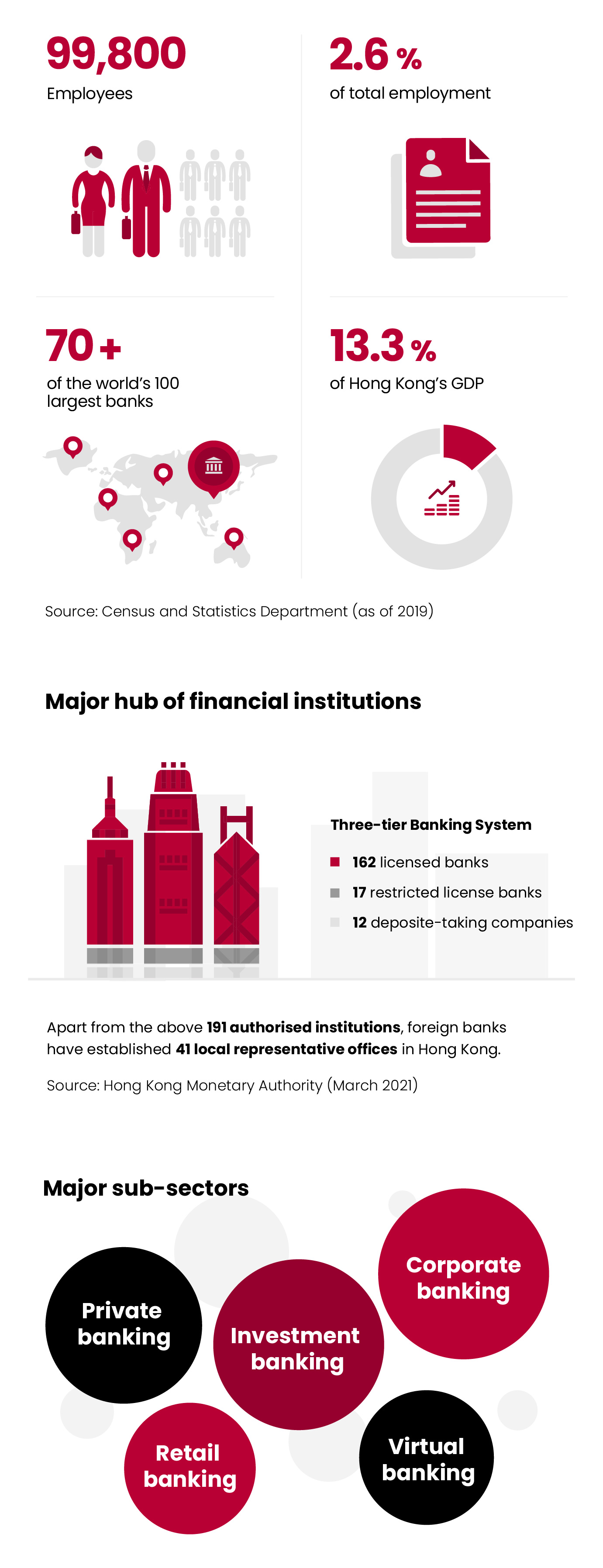

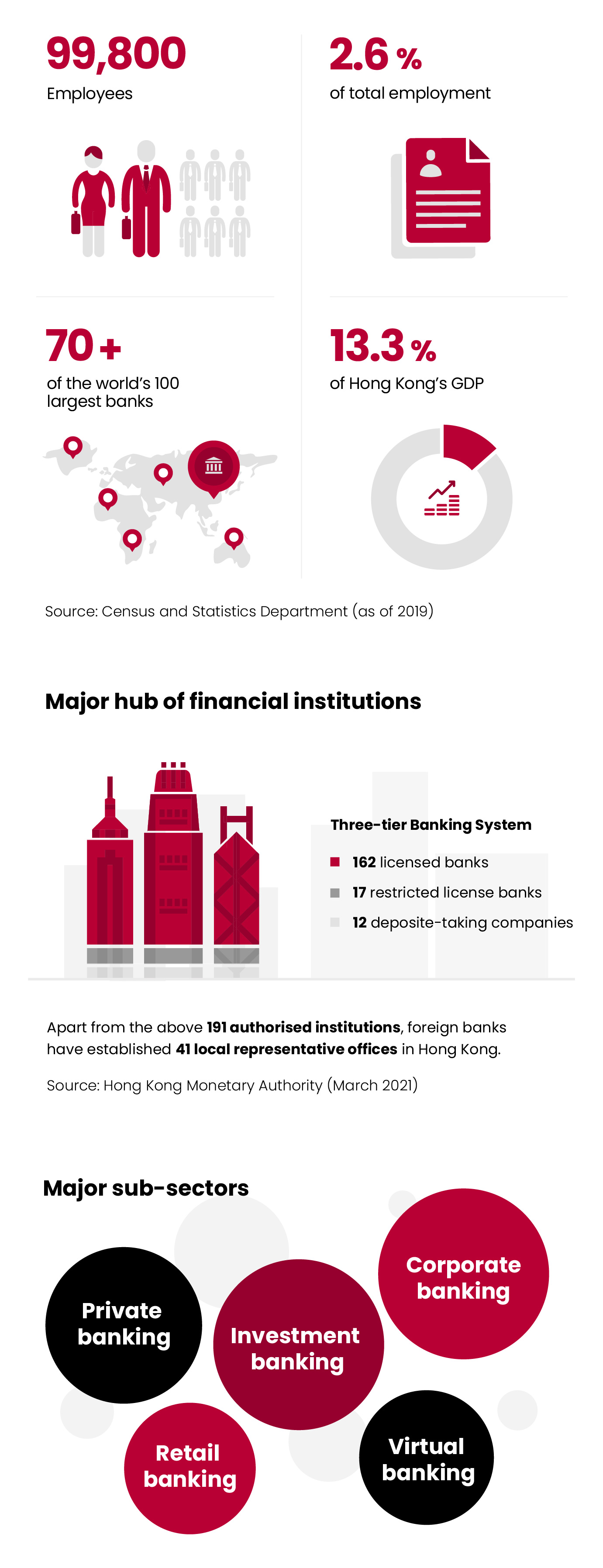

As an international financial centre, Hong Kong is a prime location for financial services and home to many international financial institutions. Over 70 of the largest 100 banks around the globe have set up branches and over 29 multinational banks have established regional headquarters in Hong Kong.[1]

The banking sector plays an essential role as an intermediary in the financial system in Hong Kong, offering a wide-ranging financial services such as deposit-taking, lending, investment and insurance. In 2019, the total assets of banks in Hong Kong accumulated to over US$3,136 billion, 3.7 times from 2000.[2]

In 2020, thanks to the strong financial positions of banks, the banking sector stayed resilient. The sector’s balance sheet rose by 5.7% in 2020 with a significant growth in deposit funding. Moreover, the sector’s capital and liquidity positions of the sector remained robust[3].

For more details about the Banking Sector, please visit the website of The Hong Kong Monetary Authority:https://www.hkma.gov.hk/

[1] https://www.hkma.gov.hk/eng/key-functions/banking/

[2] https://www.hkma.gov.hk/eng/key-functions/international-financial-centre/hong-kong-as-an-international-financial-centre/#hong_kong_financial_service_sector_at_a_glance

[3] https://www.hkma.gov.hk/media/eng/publication-and-research/annual-report/2020/AR2020_E.pdf