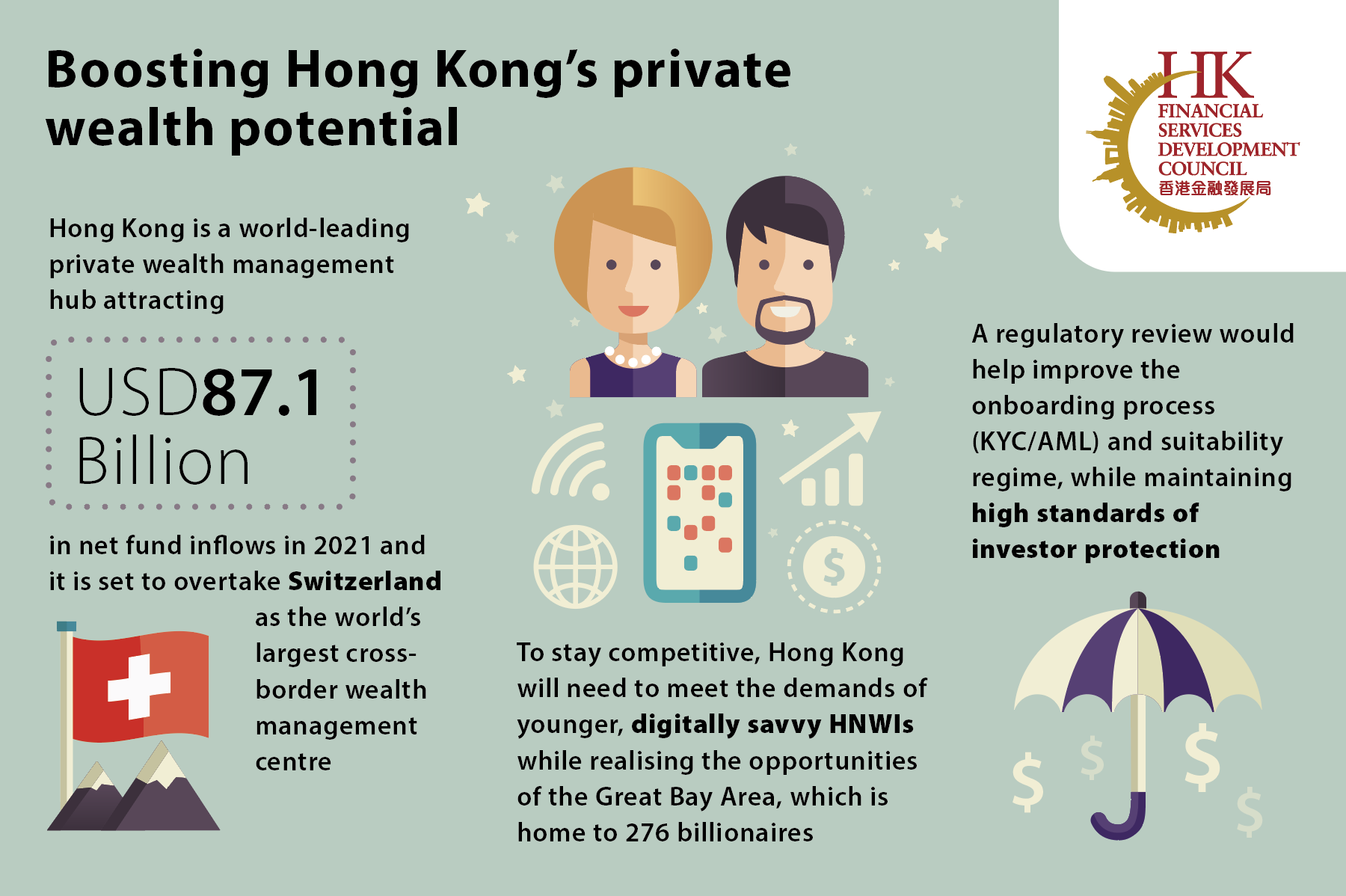

Private wealth management (PWM) is a core competency of Hong Kong’s financial services industry. In 2021, the city continued to attract wealthy investors despite a challenging market environment, with net fund inflows for the year amounting to HKD638 billion (USD87.1 billion)1. It is also set to overtake Switzerland by 2023 to become the world’s largest cross-border wealth management centre2.

For Hong Kong to build upon its leading position in PWM, the city must keep up with the demands of increasingly sophisticated high-net-worth-individuals (HNWI). How it can achieve this is the subject of a recent report by the Hong Kong Financial Services Development Council: Cementing Hong Kong’s Role as a Premier Private Wealth Management Hub in Asia3.

“It is very important for Hong Kong to maintain its competitiveness as a PWM hub by capturing emerging opportunities brought by growing wealth, which creates the need for top-quality services in nearby regions – such as the Greater Bay Area (GBA),” said King Au, Executive Director, Hong Kong FSDC, who was speaking on a panel discussing the report.

Emerging opportunities

As in many parts of the financial services industry, the future of PWM is digital. Technology enables wealth managers to improve customer service, reduce operating costs, while enhancing regulatory compliance and risk management. Pandemic-related social distancing measures and travel restrictions have accelerated the adoption of digital solutions.

Demographics also support the shift towards digital. By the end of the decade, USD15 trillion of wealth will be transferred to a younger generation that is more comfortable using a computer or a smartphone to manage their money4. At the same time, a growing proportion of HNWIs have made their fortune providing services in the new economy. In China for example, more than half of the billionaires under the age of 40 had set up their own technology or social media companies5.

“Clients expect information to be delivered to them immediately, with full transparency, no matter where they are. In short, we need to be able to deliver services in a digital format because that’s what clients want,” said Jeremy Dinshaw Lam, Board Member FSDC, and Partner, Head of Financial Services Practice, Deacons.

More broadly, Mainland China will be an important source of funds for Hong Kong’s PWM, especially the GBA, which is home to 276 billionaires6. There is already an innovative cross-border initiative that allows money to flow within the city cluster. Wealth Management Connect, launched in 2021, allows investors in Mainland China, Hong Kong, and Macao to buy wealth management products via a closed-loop channel that connects their banking systems.

Regulatory review

In order for Hong Kong to realise its full PWM potential, a balance must be struck between capturing growth opportunities, while at the same time complying with regulations and protecting investors.

Client onboarding highlights these issues. On the one hand, digital solutions in the RegTech space allow financial institutions to take on new clients remotely. But on the other hand, although Hong Kong’s regulators have provided guidance on the use of technology to help the industry comply with anti-money laundering (AML) and counter-financing of terrorism (CFT) rules, onboarding can still be costly both in terms of time and resources.

“Compliance with anti-money laundering requirements is absolutely paramount for the reputation of a financial market,” said Mark Shipman, Partner, Global Head of Funds and Investment Management, Clifford Chance. “But we need digital solutions to be able to onboard people efficiently without a face-to-face meeting.”

In its report, FSDC recommends that local regulators can provide more best practice guidance or produce Frequently Asked Questions (FAQs) documents that create greater consistency and clarity in the onboarding process, ensuring that there is consistency in the AML/CFT practices across the PWM industry.

Another area where Hong Kong’s PWM could benefit from a rethink is in the existing rules that determine whether a HNWI individual counts as a Professional Investor (PI). The current regulations date back to 2003, with a portfolio size criterion of HK$8 million, and despite a series of amendments over the intervening years, the application of PI status to a client can be challenging from a regulatory perspective.

A complete review of the PI framework would help position as a dynamic PWM hub that takes into account the opening up of the GBA, improve the overall customer experience, and facilitate the provision of a wider choice of investment products to PIs – both face-to-face and online. Any change to regulations should result in protections being given to the right investors.

“The regulations in place protect many clients who are relatively unfamiliar with investment. But there is also a class of investors who are sophisticated and experienced traders, and for whom the checks and disclosures that need to be carried out as part of the suitability process are superfluous,” said Peter Stein, CEO and Managing Director, Private Wealth Management Association.

Ensuring future success

Hong Kong’s PWM industry is operating in a rapidly evolving environment, with technology changing business models, while the growing affluence of the GBA creates new opportunities. By reviewing existing regulations, the city will be well-positioned to thrive in one of the world’s most attractive markets for wealth management. FSDC’s recommendations will help Hong Kong realise its full potential as a PWM hub that is both digital and dynamic.

1 Securities and Futures Commission

3 FSDC

4 IQ-EQ

5 CNBC