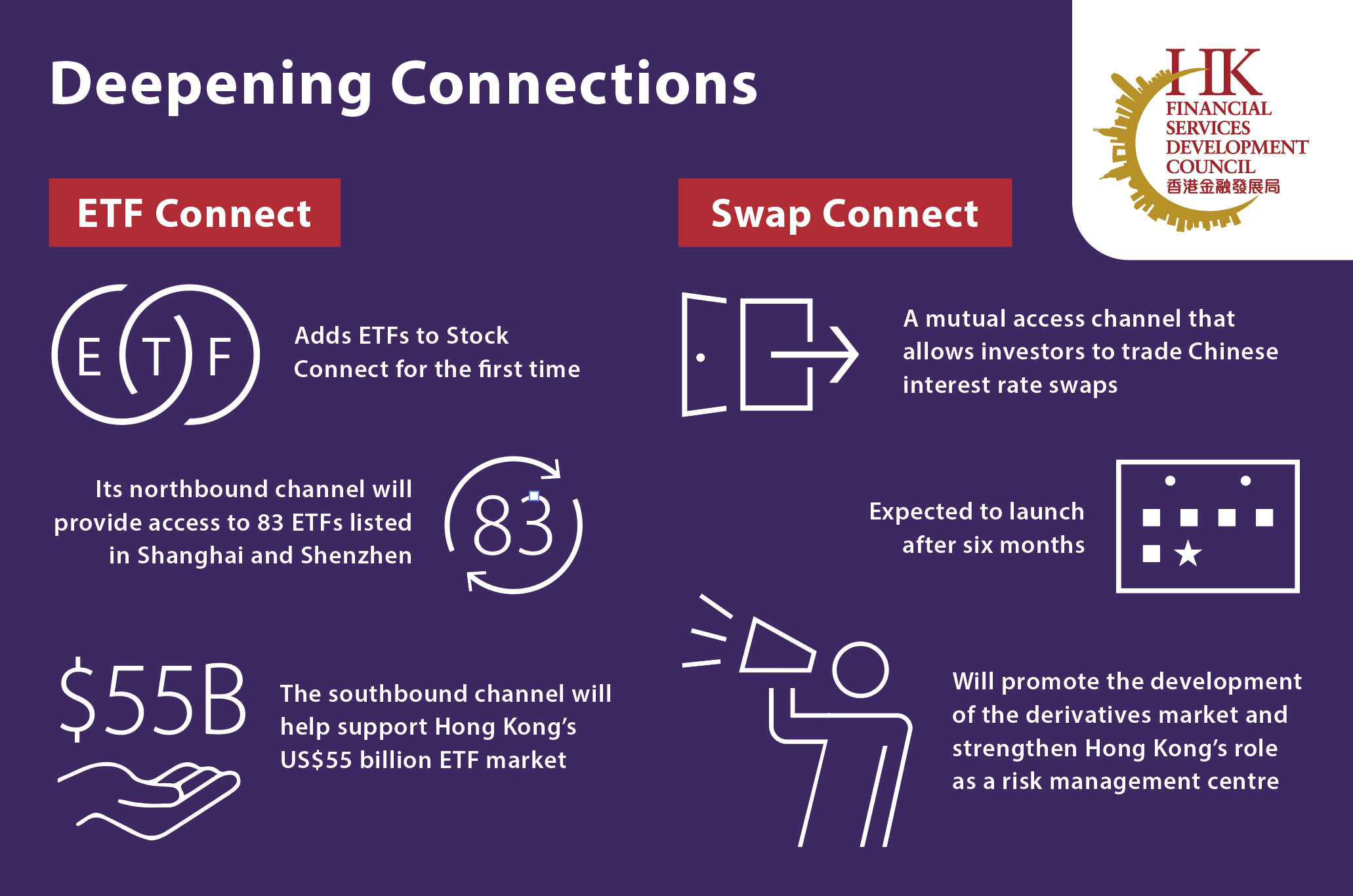

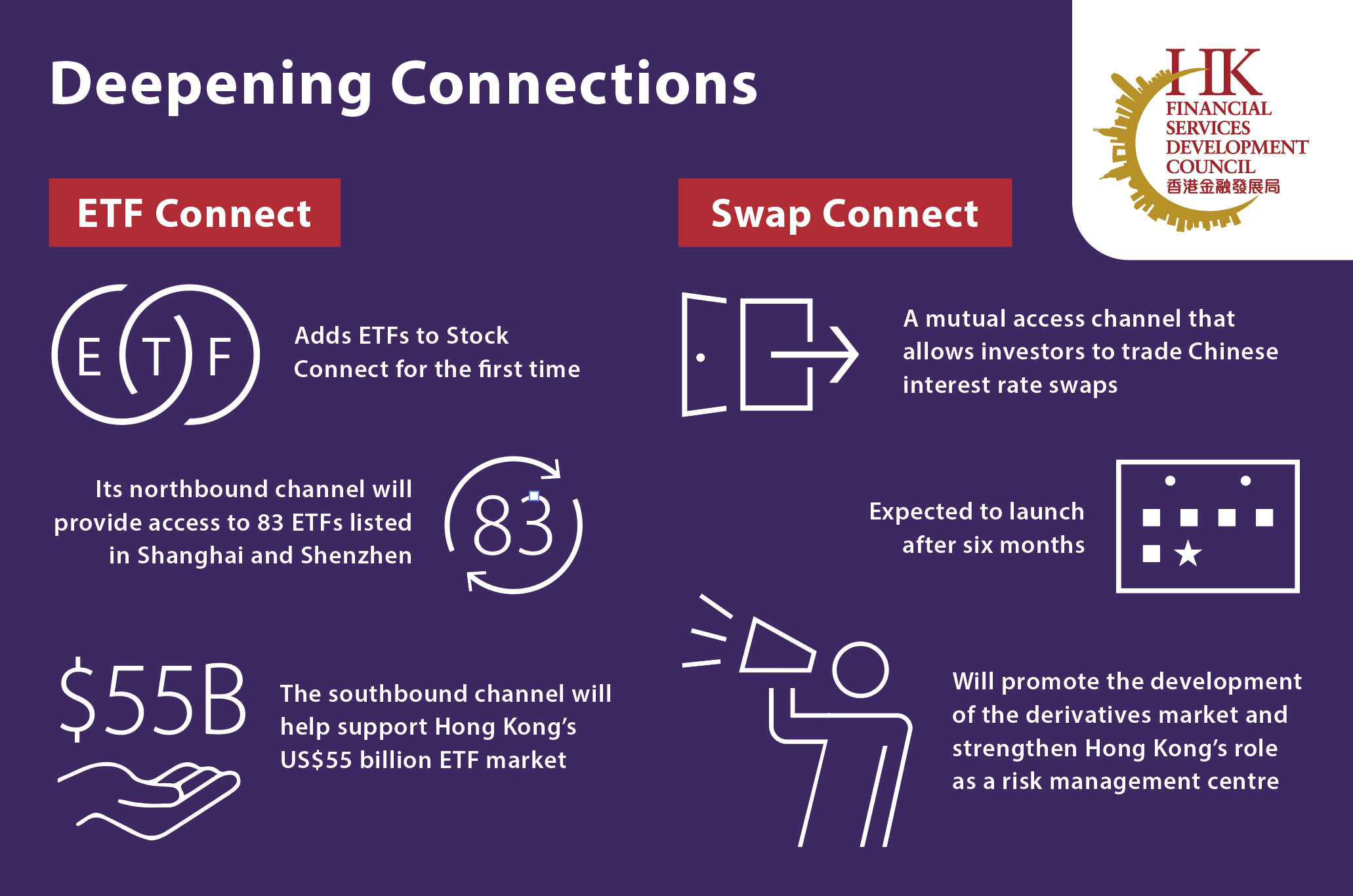

Stock Connect and Bond Connect are an integral part of Hong Kong’s market infrastructure, creating unique links to Mainland China’s financial markets. In recent weeks, the connectivity provided by these market access channels has improved significantly, due to two new initiatives that provide cross-border access to new asset classes – namely exchange traded funds (ETFs) and interest rate swaps (IRS).

Launched on July 4th, ETF Connect adds ETFs to the range of eligible securities in Stock Connect. International investors using the so-called “northbound” channel are now able to trade 83 ETFs listed in Shanghai and Shenzhen via Hong Kong1. These include products that track broad market indices, as well as products that follow specific industries.

The addition of ETFs to Stock Connect is significant, as it will help satisfy strong regional demand for these securities. In the five years ending 2021, the assets held in Asia Pacific ETFs surged to US$560 billion, from US$126 billion at the end of 20162. Hong Kong’s market is particularly diverse: the city has 130 ETFs listed locally, with an average daily turnover of HK$6.4 billion (US$820 million)3. By increasing the investor base, ETF Connect will support the growth of this asset class in both Hong Kong and Mainland China.

The other main development for the Connect programmes was the announcement of Swap Connect. This is a new mutual access channel that will for the first time allow overseas investors to trade Chinese onshore interbank financial derivatives via Hong Kong and Mainland China’s market infrastructure4. The channel is expected to launch after six months and will initially consist of a Northbound channel for IRS, with the possibility of other risk management products to be added at a later date.

When it is launched, Swap Connect will complement Bond Connect, as it will provide fixed income investors tools that they can use to manage their exposure to fluctuations in interest rates. Not only will Swap Connect promote the development of the derivatives markets in Hong Kong and Mainland China, it will also strengthen Hong Kong’s status as a risk management centre.

Taken together, ETF Connect and Swap Connect show that the mutual access channels that link Hong Kong to Mainland China continue to develop, covering an ever-broader range of assets. But beyond the access channels themselves, Hong Kong itself has multiple qualities that make it a compelling route for international investors looking to explore opportunities in onshore China, as well as investors in Mainland investors that want to increase their exposure to offshore assets.

Hong Kong’s first unique strength is its role as the world’s leading hub for offshore renminbi. Locally held deposits exceed RMB 800 billion (US$102.5 billion)5, while 73.6% of global offshore renminbi payments are processed in Hong Kong6. The ready availability of the Chinese currency means that there is an abundant supply of renminbi for investors to buy RMB-denominated assets.

The local supply of renminbi received a further boost early in July, when the People’s Bank of China and the Hong Kong Monetary Authority announced that a longstanding currency swap agreement was made permanent and expanded from RMB 500 billion to RMB 800 billion7. The enhanced Swap Agreement will ensure that there is ample renminbi liquidity available in Hong Kong.

Hong Kong’s other key strength as a connector between Hong Kong and Mainland China’s financial markets is its human capital. There is nowhere else in the world that can match the city’s experience facilitating investment flows going in and out of Mainland China. This expertise is evident across the entire spectrum of Hong Kong’s financial services industry – from investment banking to asset management, as well as legal and custodian services.

Users of Stock Connect and Bond Connect can use this deep pool of talent to find and realise their cross-border investment strategies. And with the addition of the new access initiatives, ETF Connect and Swap Connect, Hong Kong’s status as the leading connector between China and the rest of the world is set to become even stronger.

1 Initial List of ETFs Eligible for Northbound Trading (Updated as of 28 June 2022)

3 HKEX, HKEX Celebrates Launch of ETF Inclusion in Stock Connect