Sustainability is rapidly becoming a mainstream investment consideration. In addition to chasing attractive returns, investors are also becoming increasingly involved in tackling climate change, addressing social issues, and promoting high levels of corporate governance. Taken together, these environmental, social and governance issues make up the ESG framework that influences a growing range of investment decisions today.

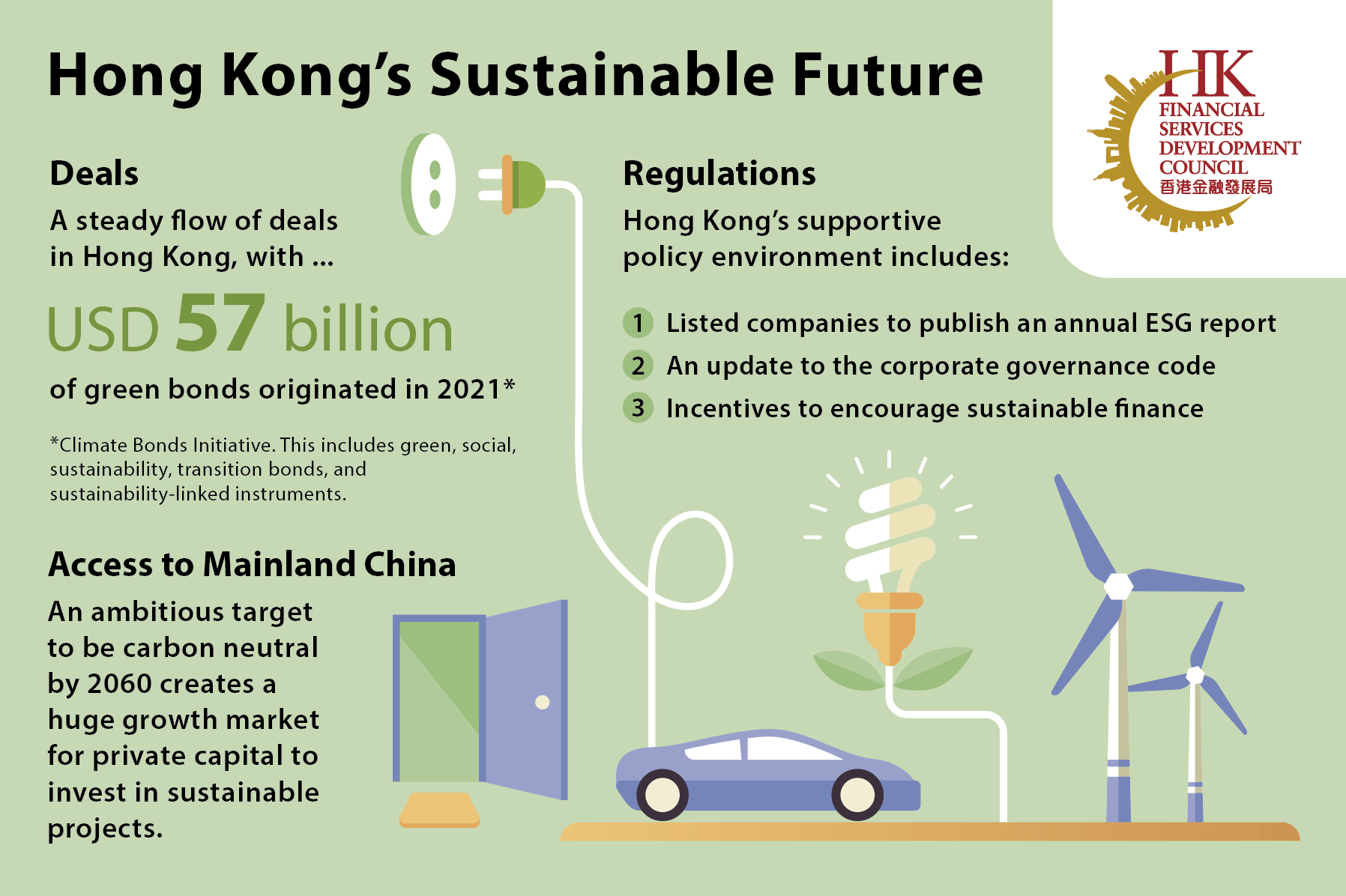

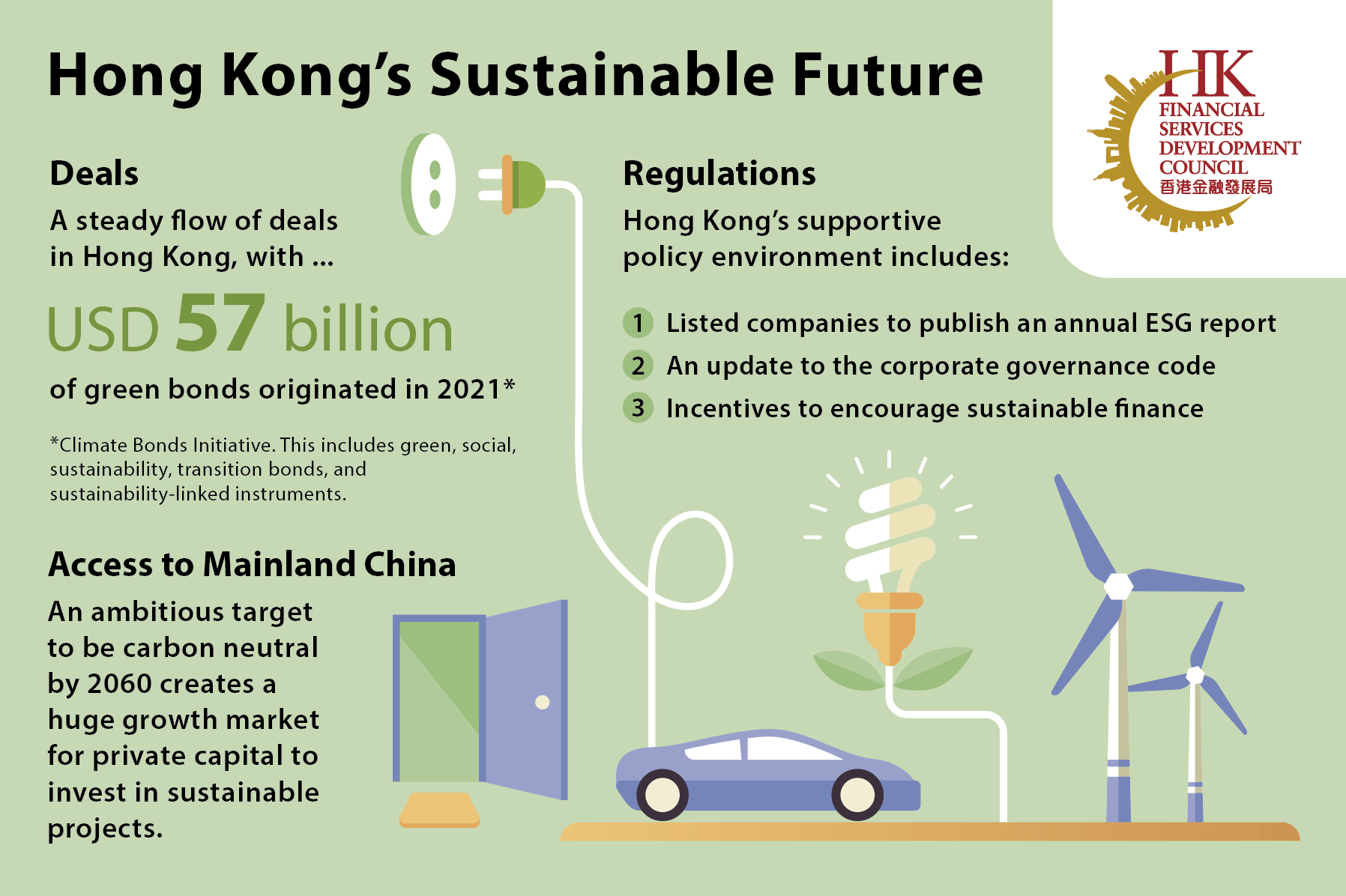

Hong Kong is at the forefront of the global development of sustainable investing. The city has a sizeable and rapidly growing green bond market, with USD57 billion originated in 20211, while the government is actively promoting the development of sustainable investment – in part by issuing its own green bonds, and at the same time nurturing a supportive regulatory environment.

Recent developments in the evolution of Hong Kong’s sustainable finance were the subject of a close-door panel discussion at the Conference hosted by the Global Impact Investing Network (GIIN) in the Netherlands.

Making an impact

One of Hong Kong’s major strengths is its role as a connector, linking the vast market of Mainland China to the rest of the world. As the world’s second largest economy, Mainland China has a huge environmental footprint, which means that Hong Kong’s unique connectivity provides significant opportunities to sustainability practitioners.

“Hong Kong is the best place to engage with China, understand the market, and really participate in driving the change in sustainability,” said Vivien Teu, Partner, Head of Asset Management and ESG at Dentons Hong Kong and who leads sustainable finance under Dentons Global ESG Steering Group.

She highlighted efforts made by Hong Kong regulators, giving credit for raising reporting standards for listed companies to publish annual ESG report in the nature of impact report covering environmental and social aspects, as well as recent updates to the corporate governance code to emphasise the responsibility of the board directors on governance and oversight of ESG matters and on corporate purpose, values and strategy that aligns with corporate culture. Besides the public equity markets, there has been strong government incentives to encourage sustainable finance – from green to sustainability-linked loans and bonds. These establish strong sustainable finance policy and regulatory framework that serve as examples globally and are significant towards driving better ESG data and performance of companies listed in Hong Kong, including Mainland China companies raising capital in Hong Kong.

Concrete results in sustainability

New World Development is a Hong Kong company that is active in sustainable finance, having issued its first green bond in 2018. As one of the city’s largest real estate firms, with investments across China, the company has completed a series of successful deals, financing buildings that meet the highest environmental standards.

In June 2022, New World Development became the first corporate in the world to issue a USD-denominated social and green perpetual dual tranche bond in the public market. This USD700 million deal will help the company continue its commitment to building sustainable cities and communities, and it is part of an ongoing effort to address the growing sustainability concerns of the investment community.

“I keep a very regular and open dialogue with investors because they are important supporters of our annual sustainability assessment, which allows us to discuss what is most important to our stakeholders,” said Edward Lau, Chief Financial Officer, New World Development.

This collaborative approach delivers concrete results. This year, stakeholders expressed an interest in gender diversity, said Mr. Lau. In response, the company appointed three female board members, increasing the percentage of women on the board to more than a third.

Mainland China opportunities

In recent years, there has been a change in attitudes towards sustainable investments, said David Chan, Managing Director and Partner at Boston Consulting Group. In the past, few investors believe environmental and social considerations may generate meaningful alpha returns.

“That perception has changed significantly over the last few years, because the sustainability concept has generated very concrete businesses that have real potential – such as those involved in alternative energy and cleantech,” he said.

With an ambitious target to reach peak CO2 emissions by 2030 and be carbon neutral by 2060, China represents a huge growth market for sustainable projects. But Mr. Chan also emphasised the importance of understanding the Chinese market characteristics – for instances, the importance of transition finance, and potential opportunities to support the country policy’s emphasis such as rural urbanization, common prosperity, public health.

One common misconception about investing in China is that there is no room for private capital in infrastructure projects, with state-owned companies dominating the market. While this might be true for the largest projects, the enormous demand for solar and wind farms in the country creates openings for international investors.

“There are a lot of opportunities in renewable projects in Mainland China that are not very well known by the rest of the world,” said Conrad Yan, Co-Managing Partner, Albamen Capital Partners – a Hong Kong-based private equity fund active in China’s renewable market.

In June, Singapore’s Sembcorp Industries bought a portfolio of ten renewable projects to for RMB3.3 billion (USD494.5 million) that was created by the Albamen team. The assets consist of solar and wind projects located close to Beijing that offer a rate of return that is significantly higher than comparable projects in Europe.

A sustainable future

With supportive government policies, unique access to an enormous market for renewable projects, as well as an active promotion for green bonds, Hong Kong is on track to be a pioneer in an increasingly sustainable world. By being part of this exciting development, corporates, investors and other sustainability practitioners will find new ways to realise their ESG strategies.

1Climate Bonds Initiative. This includes green, social, sustainability, transition bonds, and sustainability-linked instruments.